Equitable Pricing Guide

The question of who should pay what amount can evoke a range of emotions and often proves challenging. Here are some resources that can help you consider your financial privilege and/or needs.

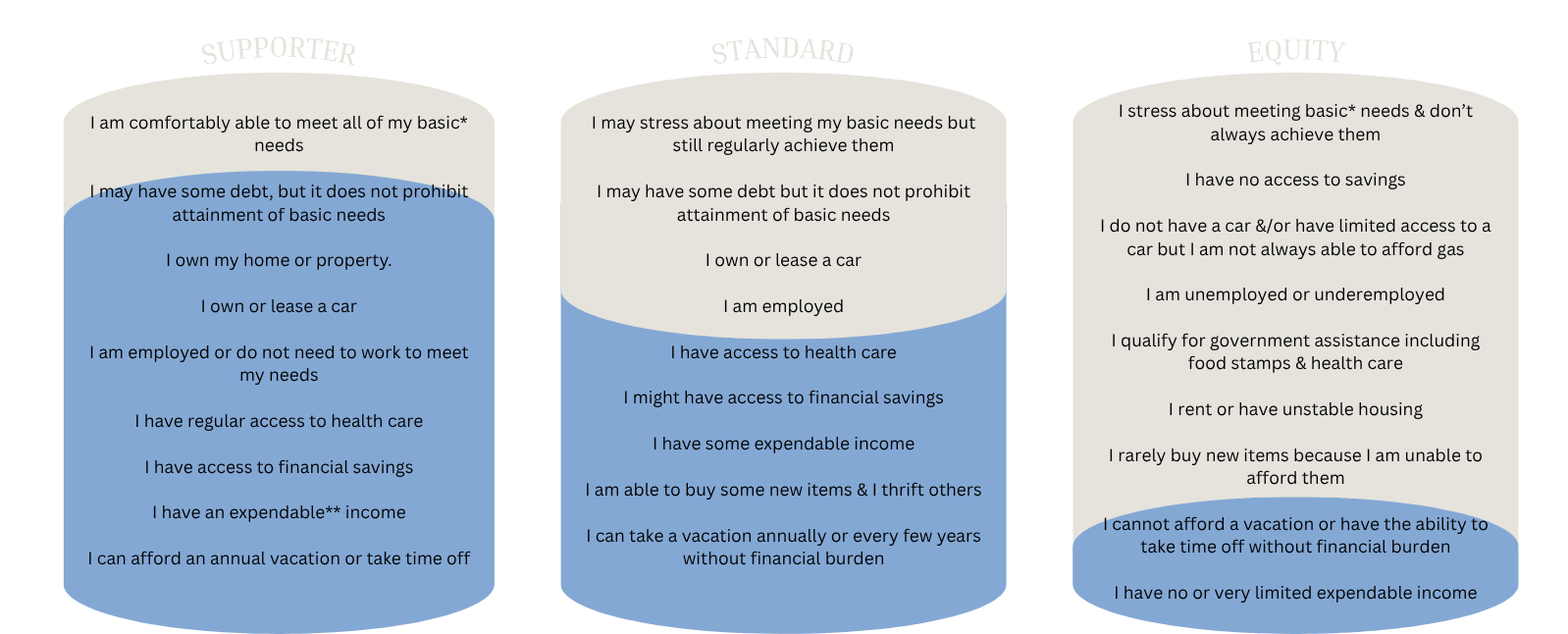

I created the following visual to help you assess your financial needs and/or privileges, inspired by the work at Worts & Cunning Apothecary.

Standard Rate: this is the going rate

I may stress about meeting my basic needs, but still regularly achieve them

I may have some debt, but it does not prohibit attainment of basic needs

I own or lease a car

I am employed

I have access to health care

I might have access to financial savings

I have some expendable income

I am able to buy some new items & I thrift others

I can take a vacation annually or every few years without a financial burden

Equity Rate: this rate is for people experiencing financial hardship

I stress about meeting basic* needs & don’t always achieve them

I have no access to savings

I do not have a car &/or have limited access to a car, but I am not always able to afford gas

I am unemployed or underemployed

I qualify for government assistance, including food stamps & health care

I rent or have unstable housing

I rarely buy new items because I am unable to afford them

I cannot afford a vacation or have the ability to take time off without financial burden

I have no or very limited expendable income

Supporter Rate: this rate is for those with the means to help us offer the equity rate

I am comfortably able to meet all of my basic* needs

I may have some debt, but it does not prohibit attainment of basic needs

I own my home or property.

I own or lease a car

I am employed or do not need to work to meet my needs

I have regular access to health care

I have access to financial savings

I have an expendable** income

I can afford an annual vacation or take time off

If you need an equity rate, use the code EQUITY on a Standard Price offering for a reduced price.

Our financial position is greatly influenced by our ability/disability status, career income, household or generational familial wealth, etc. My goal is to ensure that people from all financial backgrounds have access to wellness.

You are free to choose from the three rates at your own discretion. This means that you are not required to prove or explain your financial need. By offering the freedom to choose, pricing for offerings becomes more collaborative and invites us all to reflect on personal and collective responsibilities of sharing financial privilege and access.